ACTIONABLE CYBER RISK DATA FOR U.S. INSURERS

Confidently underwrite cyber risk faster and reduce your loss-ratios

KYND is a cyber risk management solutions provider whose products make assessing, understanding and managing cyber risk easier and faster than ever before.

We provides insight into the cyber vulnerabilities you want to track, streamlining cyber risk underwriting, portfolio management, and exposure modeling. With up-to-date, transparent data, KYND enables profitable underwriting based on relevant metrics, not subjective scores.

- Make well-informed underwriting decisions

- Reduce risk and seize sales opportunities

- Monitor cyber health of in-force policies

Get In Touch

Your secret weapon for effective cyber risk analysis

KYND's technology helps you identify and understand organisations' cyber risk in minutes with on-demand analysis that speaks your language. Once your portfolio is set, we'll help you keep those risks in check with continuous monitoring and timely alerts.

Price policies accurately

Confidently make well-informed underwriting choices, and price policies objectively.

Avoid adverse selection

KYND identifies vulnerabilities that lead to losses and claims, so that you can steer clear of them.

Say Ciao to multilingual reports

Don't let risk accumulate in your portfolio, and spot trends or threats as they emerge.

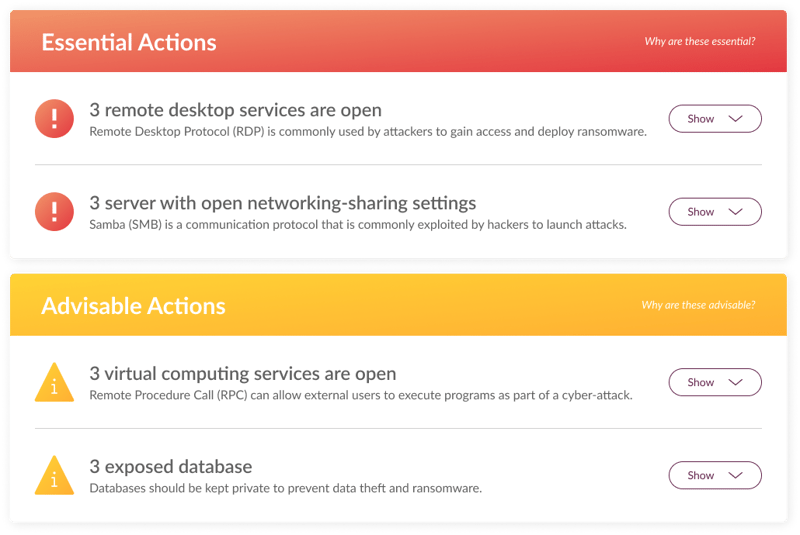

Access transparent data

Instead of scores, KYND gives you transparent, relevant, and actionable risk insights.

Streamline cyber risk selection

The right data is essential to financially quantify cyber risks, as unknown vulnerabilities and incorrect evaluations can lead to flawed attachment points and increased claims.

KYND provides actionable, up-to-date intel on the specific risks that matter to your organisation. Make well-informed decisions to avoid potential losses and seize sales opportunities. Plus, send user-friendly cyber reports to applicants, helping them tackle critical issues with ease.

Track portfolio health and zero-day vulnerabilities

KYND lets you continuously monitor your portfolio's exposure to emerging threats and support your insureds in promptly addressing zero-day vulnerabilities by sending them actionable reports.

That way, you can keep track of the cyber hygiene of your in-force policies and help prepare insureds for renewal, ultimately safeguarding your renewal rates.

Simulate scenarios and prepare for reinsurance

With KYND, you get accurate insights into risk accumulation, helping you understand exposure concentrations. Simulate customized cyber incident scenarios to gain a clear view of their potential impact on your portfolio.

Additionally, KYND’s scenario modeling enables you to present a well-informed risk profile to the reinsurance market, optimizing your reinsurance preparation.

How it works

Does it all sound like magic? ✨

Well, it is - in the form of user-friendly, proprietary technology.

Get all the information you need on applicants or policyholders in one place, in an instant. Our API makes integrating KYND’s easy-to-understand, accurate, on-demand results into your systems a piece of cake.

“KYND's powerful combination of actionable cyber risk insights and expert advisory services enables Beazley underwriters to quickly and accurately obtain the right information they need to assess the risks and provide the right cover and solutions to protect businesses from cybercrime.” Paul Bantick, Global Head of Cyber and Tech, Beazley

Integrating KYND’s insight into our cyber arsenal will not only support the sustainable and profitable growth of our cyber portfolio, but will also become an integral component in aiding our customers to strengthen their digital defences and mitigate risks before they escalate into cyber incidents. Rob Jones, Executive Chairman and Head of Media, Technology and Cyber, Nirvana UW

KYND’s insurance focus and unrivaled approach to cyber risk management, coupled with the flexibility and transparency provided by its innovative deterministic cyber catastrophe modelling, made partnering with them an easy decision to enhance our underwriting and portfolio risk management capabilities, and help inform capacity decisions. Richard Taylor, Head of Cyber & Technology, Probitas 1492

Connect with a cyber expert today

Curious if we're a good fit for your organization?

Get in touch to explore how we could help you enhance your cyber risk management today.

ACCREDITATIONS AND FEATURES: